how to calculate taxes taken out of paycheck in illinois

This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed.

Illinois Self Employment Tax Calculator 2020 2021

It can also be used to help fill steps 3 and 4 of a W-4 form.

. Total annual income - Tax liability All deductions Withholdings Your annual paycheck. The average tax rate for those in the lowest income tax bracket is 106 percent higher than each group between 10000 and 40000. If you earned a pension in 2018 youll need to fill out Form IL-1040 and.

Illinois income tax rate. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only.

Everyones income in Illinois is taxes at the same rate due to the states flat income tax system of 495. Details of the personal income tax rates used in the 2022 Illinois State Calculator are published below the. Unless an employee submits a Form W-4 claiming exemption the employer must deduct federal income tax.

Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. After a few seconds you will be provided with a full breakdown of the tax you are paying. Illinois Paycheck Quick Facts.

This calculator is intended for use by US. Illinois Hourly Paycheck Calculator. The tax calculator provides a full step by step breakdown and analysis of each tax Medicare and social security calculation.

What are the 4 main taxes taken from. 62 of each. For those who make between 10000 and 20000 the average total tax rate is 04 percent.

Supports hourly salary income and multiple pay frequencies. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. Median household income in Illinois.

How Your Illinois Paycheck Works. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Youll use your employees IL-W-4 to calculate how much to withhold from their paycheck.

The illinois paycheck calculator will calculate the amount of taxes taken out of your paycheck. If youre a new employer your rate is 353. Illinois State Income Tax.

What taxes come out of paychecks in Illinois. Switch to Illinois hourly calculator. That means the money comes out of your.

Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Newly registered businesses must register with IDES within 30 days of starting up. Also not city or county levies a local income tax.

What percentage is taken out of paycheck taxes. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. Taxable income Tax rate based on filing status Tax liability. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

SmartAssets Illinois paycheck calculator shows your hourly and salary income after federal state and local taxes. Supports hourly salary income and multiple pay frequencies. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The average tax rate for taxpayers who earn over 1000000 is 331 percent. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Adjusted gross income - Post-tax deductions Exemptions Taxable income. The employee will need the difference paid as retro pay for the 40 hours in the prior period back to the date the raise should have taken effect.

Use the advanced salary calculations to tweak your specific personal exemption and standard deductions. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Like a 401k FSA or HSA allow you to make pre-tax contributions.

What Taxes Are Taken Out of a Paycheck in Illinois. Personal income tax in Illinois is a flat 495 for 20221. Overview of illinois taxes illinois has a flat income tax of 495 which means everyones income in illinois is taxed at the same rate by the state.

The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. In Illinois the Supplemental wages and bonuses are charged at the same state income tax rate. It is not a substitute for the advice of an accountant or other tax professional.

The wage base is 12960 for 2021 and rates range from 0725 to 7625. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. How to calculate taxes taken out of paycheck in illinois Monday March 7 2022 Edit.

Illinois Hourly Paycheck Calculator. Our online Weekly tax calculator will automatically work out all your deductions based on your Weekly pay. This means that you get a full Federal tax calculation and clear understanding of how the figures are calculated.

This free easy to use payroll calculator will calculate your take home pay. Combined the FICA tax rate is 153 of the employees wages. Helpful Paycheck Calculator Info.

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income Tax Rates and Thresholds in 2022.

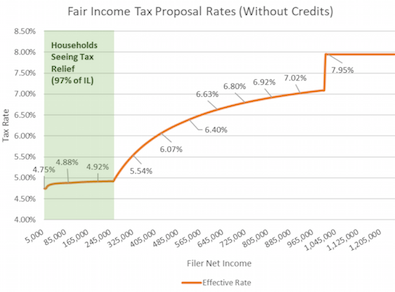

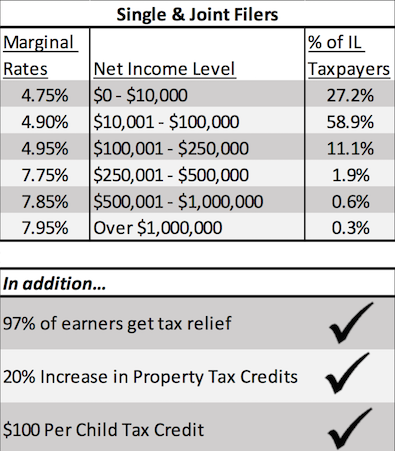

Pritzker S Progressive Tax Push A Guide For The Ordinary Illinoisan Wirepoints Special Report Wirepoints

Capitol Fax Com Your Illinois News Radar Mobile Edition

Illinois Paycheck Calculator Updated For 2022

Illinois Income Tax Calculator Smartasset

Illinois Income Tax Calculator Smartasset

I Live In Illinois Work In Wisconsin How Do I Pay Income Tax

May 16 2022 Is New Tax Day For Illinois Tennessee Tornado Victims Don T Mess With Taxes

Where S My Illinois State Tax Refund Taxact Blog

Illinois Paycheck Calculator Smartasset

Here S How Much Money You Take Home From A 75 000 Salary

Illinois Paycheck Calculator Smartasset

Capitol Fax Com Your Illinois News Radar Mobile Edition

Illinois Salary Calculator 2022 Icalculator

Illinois Sales Tax Calculator Reverse Sales Dremployee

A Complete Guide To Illinois Payroll Taxes